Realistically speaking, buying a home may be the single largest (and most emotionally invested) purchase you will ever make in your life. Yet unfortunately, it is also vulnerable to unforeseen events. Whether it be a natural disaster, theft, or even an accidental injury, you can rest assured knowing that we have you covered with our wide level of protection. Without further ado, here are four major benefits of having home insurance.

Protection from Natural Disasters

It is undeniable that the idea of a fire, an earthquake, or a storm hitting your house is a scary thought. This thought is all the more scary when you come to the realisation that you can never truly predict when and how these disasters will strike. With our home insurance policy, we will be there to protect you if such unforeseen events do present themselves.

Possibility of a Break-in

Everyone hears about stories involving burglaries and house break-ins on the news, yet no one ever considers the possibility of it happening to them. We totally get it though. The notion of it occurring to you is easy to take for granted since no one ever really expects it to happen to him or her. Nevertheless, doing that will not protect you if a break-in were to happen. Whether it be damage to your property or stolen valuables, home insurance will provide you protection from those losses.

Necessary for your Mortgage

For the most part, your mortgage lender will not likely grant you with a home loan unless you have insurance. This should come as no surprise since, understandably, the lender will want to protect this steep investment just as much as the buyers themselves do.

Liability Coverage

You would think that the complications would come to a halt after natural disasters, break-ins and paying off a mortgage. However, this is sadly not the case, and the former are not the only things that homeowners need to consider. It is also very possible that as a homeowner, you could find yourself in a less-than-ideal scenario of someone having an accident on your property, resulting in injury. With home insurance, those medical bills along with any other related damages are covered.

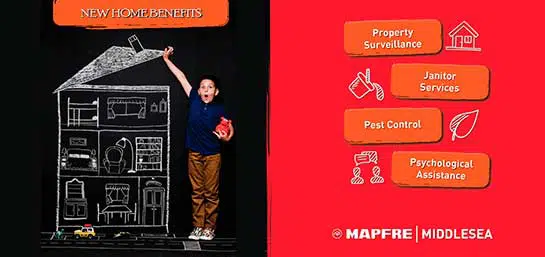

Before we dive into our main home policy enhancements, let’s take a look at some of the great perks that MAPFRE Middlesea clients can already benefit from:

- In the unfortunate scenario of your structure potentially collapsing due to any neighbouring works, you can rest assured knowing that our home insurance policy will cover you for those damages.

- Home policyholders can benefit from FREE 24/7 Home Assistance and Emergency Services to ensure that everything remains as right as rain within the comfort of your own home.

If that’s not already enough, then we implore you to continue reading. Trust us, it’ll be worth your while! Now we’ll be delving into some of the main enhancements made to our home insurance policy.

Main Home Policy Enhancements

As of April 2020, MAPFRE Middlesea have made a number of enhancements to their existing home policy, such as:

- In the case that access to your home cannot be restored immediately, an appointment for a security guard will be scheduled at the first available convenience until access can be secured.

- In the case that you are rendered and certified immobile by a medical advisor, an appointment for a janitor service will be scheduled at the first available convenience.

- In the case that your home or part thereof is infested with pathogenic pest, an appointment for a pest controller visit will be scheduled at the first available convenience.

In the case that you suffer a covered fire or theft loss at your home and require psychological rehabilitation, an appointment will be scheduled at the first available convenience. - Payment for accidental loss and/or damage insured under this Policy to prams, pushchairs and wheelchairs whilst anywhere in Malta.

- Covering the cost of replenishing firefighting appliances and accidental loss and/or damage to such appliances following an insured fire in your home.

- Payment for loss of earnings and expenses you cannot get back as a result of serving as a juror for a period in excess of 14 days.

The Verdict

Even though home insurance may feel like just another expense to you, there truly is no telling what could crop up in the future. And let’s face it, there’s no denying the satisfaction you get when having your mind at rest, knowing that if something does go wrong the investment will have been well worth it.

After all, it will pretty much cost you less than a cup of coffee per day to protect your hard-earned investment.

Still undecided about home insurance? Be sure to check out our website to gain a full understanding of the benefits you will have with our home insurance policies!

Get a Home Quote now!

https://www.middlesea.com/insurance-mt/individuals/home-insurance/